When you will use this money: Within one year

Where this money lives: Checking Account

If you read my first article in this series, you might remember that immediate spending is the money in your checking account that you use to pay all your daily expenses (rent, bills, food, etc). This article is supposed to be about your checking account—but since I’m not going to explain how to open/use a checking account, that’s a little misleading. Let’s just say, I am confident that you’ve used a checking account before—if you haven’t, you can read about it here. This article is about how the money you spend from your checking account affects the ways you save.

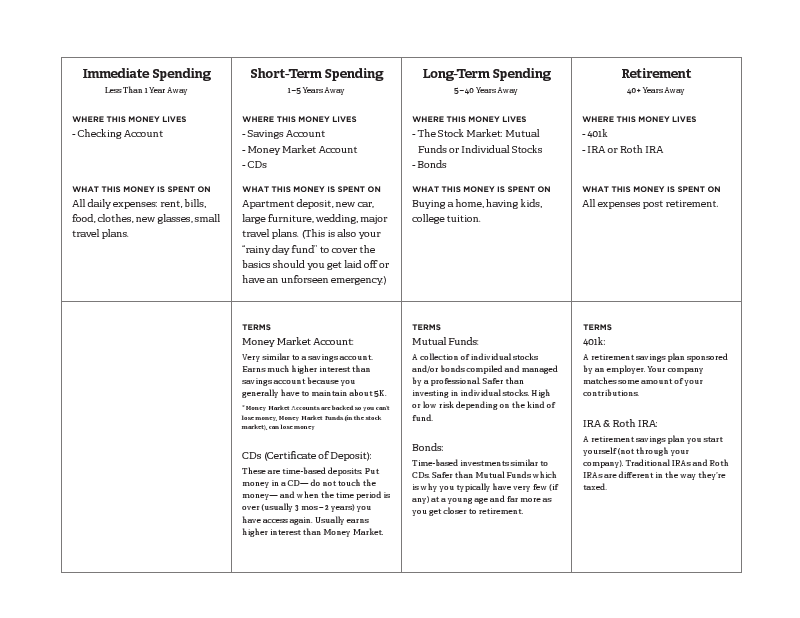

That’s right—we’re talking about the dreaded “B” word. No, not Brussels sprouts—we already covered that one. Budgeting. Determining how much money you have to save depends a lot on what your budget is. We’re going to go over: (1) my recommendation for the best way to budget, (2) figuring out how much money you have to save, and (3) where to put those savings. I am going to focus on how your paycheck should be divided among the categories I talked about last time: immediate spending, short-term spending, long-term spending, and retirement.

Your first task is to understand how you spend your money. In other words: track your expenses. There are two ways to do this: the easy way or the hard way. The hard way is to do it manually. To actually track for a month (and ideally more) how much you spend by keeping receipts and making a spreadsheet of everything you spend money on by category. If you prefer this option because you enjoy having a wallet overflowing with receipts, please refer to this article on How to Track Your Money. If, on the other hand, you like things to be simple, pain-free, and endlessly informative—ooh! me! me!—you should check out Mint.com.

If no one has ever told you about Mint.com, you are in for a treat because it will completely change the relationship you have with your money. Mint.com automatically tracks all your money for you. It is connected to your credit cards, bank accounts, investments, loans—you can even add property to give you a bird’s eye view of your assets and worth.

And it’s safe. You cannot move money within Mint.com, you can only see it. It will show you your net income every month (how much you make minus how much you spend) and help you create a budget and set goals. It even has pretty charts that break down your spending. Best of all, it’s free! I could go on and on, but I’d rather let Mint.com do it for me in their 90-second overview video.

Once you’ve tracked your expenses, the next step is to determine how much net income you have each month. Again, this is how much money you make minus how much money you spend. So, if you make $3,000 and spend $2,700, then you are netting $300 every month. Once you’ve set up your Mint.com account (or tracked your spending manually if that’s how you roll), you will be able to figure this out quickly. If you’re using Mint.com, simply look in the right hand column at the bottom and you will see your net income for the past 6 months. Green is good. You want to be making more money than you’re spending. If you’re not making money every month, you need to change your spending habits to get yourself back in the green. (I know—this can be hard—I promise another article later if you’re still having trouble.)

Ok, we’re going to break out a little math here. Let’s say your net income is $200 on average every month and you currently gross $2,000 a month (gross is the money you make before taxes). That means you are netting (and saving) 10% of your income ($200/$2,000 = .10). This is a great start. If you can do this—you should be happy. According to the pros, your eventual goal should be to net (and save) 15% of your gross (before taxes) income. So, if you gross $2,000, you should be aiming to save $300 of it ($300/$2,000 = .15).

Saving 15% of your income before taxes can be hard. Don’t get discouraged and don’t feel overwhelmed. Be realistic. You’re young. If you can save $20 a month—save that and increase as you can. Even if it’s small, remember why you’re saving, keep an eye on your budget, and make it a priority.

Now let’s talk about where this money you are saving is going. If you’ve just recently started saving, you want to focus on building up your short-term savings (your rainy day/emergency fund) and your retirement account. Don’t even think about the Stock Market until you’ve got this whole saving thing on autopilot with a very happy rainy day fund.

To make this a little easier to understand, this is how I save my money every month: My paychecks automatically go to my checking account. Before they get there, a portion is automatically taken out for my retirement fund (8% of my gross income after my contribution is matched by my company). Once a month, I automatically transfer a set sum from my checking account into my savings account (7% of my gross income). Note how much of this process is automated—all of it. Unless something drastic happens, all my saving will happen automatically. My goal is to keep my checking account at a fairly steady number (about two months worth of spending) while growing my savings and retirement accounts with the income I net every month.

So, what does this mean for you. Well, it depends. Are you hoping to buy a car soon? Planning a wedding? Trying to backpack around Patagonia in the near future? Then, you might want to focus on putting money more heavily in to your short-term savings (and maybe even open a separate account for the wedding and traveling). But don’t focus too heavily on the short-term and neglect your retirement fund. You can’t take a loan out for retirement.

Once you’ve built a cushion in your savings account, try splitting your money between short-term savings and retirement. If your company offers a retirement plan that matches the money you put in, make every effort to contribute the maximum amount they will match because THIS IS FREE MONEY. Do it as soon as it’s available to you. Whether or not your company sponsors your retirement fund or you are doing it yourself, have your retirement money taken out of your paycheck before you ever even see it.

Whatever you do, create a plan that you can consistently follow and then keep with it. Push your budget to reach that 15% savings mark and more. Think of sticking to your budget and saving your net income as a game you have to win. Oh wait—there’s an app for that: SmartyPig.com (and Mint.com.)

If you’re still not convinced saving is important, check out Mike Dang’s article about saving on The Billfold.

Even if this all seems overwhelming, it is never going to be easier to save than it is when you’re young before you have a lot of financial demands on you like kids, a mortgage, or a business to take care of. Keep track of your spending, aim to save 15% of your paycheck, and put that money away. Once you have a plan in place, staying on track gets easier and easier.

Photo by Meaghan Morrison