Tag Archives: savings

I was a Credit Union Virgin

I have worked at the same job, in the same building, for three and a half years. During that entire time, I have never ventured in to the mysterious tiny office next to our cafeteria. It only ever has one or two employees working inside and just the occasional customer. It contains a branch of the NARFE credit union, open exclusively for Federal employees and their families, and I’m their newest member.

Before last month, I was never curious about what a credit union could do for me. I’m not sure why. I had a small loyalty to Bank of America, but they were often more trouble than they were worth. Fees that changed year-to-year, clunky online management services, and, worst of all, poor customer service all put a bitter taste in my mouth. Yet, I’d never considered switching until a coworker told me he used NARFE to help grow his savings. That caught my attention.

In my first year at my job, I briefly considered looking into NARFE but a few things about how they operated, or my perception of it, kept me away. They weren’t a “real” bank so there weren’t tellers, a large safe, or many staff members. The concept was foreign, and I couldn’t see how it would work. It also had very few branches, meaning I wouldn’t have access to someone in-person when I wasn’t at work. I hated the concept of something so seemingly unstable. Especially in my first few years out of school, I craved stability in every way I could get it. Switching banks seemed like a risk I just didn’t want to take.

But once I had a better financial plan and a clearer head about what makes good customer service (hint: it’s not fancy tellers and tons of branches, I promise you), a new bank became a much more attractive option. Saving and I have always been in a love/hate relationship, and it’s only been in the past two years or so that I’ve come to understand the real value of it. So, one Sunday a few weeks ago, I sat down and looked up all NARFE had to offer. Every credit union is different, but let’s just say my mind was blown.

The great thing about credit unions is that they are, for lack of a better term, low maintenance. Because they don’t put a lot of money into branches and staffing, they are able to save money on actual services. The big kicker? Their interest rates. They were the lowest I had ever been offered, especially while still developing credit.

As I knew I was going to buy my first new car soon (update: It’s bought! Name suggestions in the comments, please!) this piqued my interest even more. Then I looked at the rates they offered for checking and savings as well as their fantastic gap insurance for cars, mortgage rates, and other services. After that, I was raving to everyone about how much I love credit unions.

But the truly best thing was the customer service. The branch manager, who also happens to service most of the branch’s customers, is one of the nicest and most accommodating people I have ever met. His sense of humor is fabulous and his determination to help you no matter the situation is truly impressive. He actually makes an effort to know all of his customers and go the extra mile for them whenever possible. Since our first meeting, he now calls out to me when I pass by with my lunch, he helped me carry a heavy whiteboard he saw me walking with, and he stayed a half an hour late one day to help me with my application because he knew I had meetings that delayed me getting to him. That never happened at any of my Bank of America branches.

There are definitely a few down sides, the biggest being the limited branch hours and locations. But because so much of the services I need are online, and most ATM fees are refunded, I don’t really require a branch for my day-to-day needs.

I’ve been proven wrong many times in my life. I swore I would never own a Mac, move to California, or adopt a cat. Well, I love my Mac, I hope to move to California, and my two cats are very fond of me. So I should have known my disinterest in credit unions would change over time, too. It feels good to be wrong.

Photo by Andy Sutterfield

Thinking About Your Money

Once you reach your twenties, you’re expected to know a lot of things. You’ve gotten to a point where you are expected to know how to work, feed, and clothe yourself—but having an actual plan for your paychecks may not be something you’ve figured out yet. We all have a sense of the lifestyle we want to live—whether that’s buying a house, starting a business, or traveling the world—but often we don’t spend enough time on the road map that will actually get us there.

Financial planning is a subject that young people are often uncomfortable with. There are so many technical terms you’re magically supposed to understand—but what if no one ever told you which ones really matter? I get it. I went to school for design, and no one was teaching me how to make the most from my money.

Luckily, my parents understood that this is confusing for those of us just starting out and were able to answer most of my questions. So, the advice I lay out here comes to you from someone who was a novice but has learned a lot recently by making small but important changes to the way I think about my money. This stuff is scary—you’re making decisions about large amounts of money. But it would be scarier to turn 30—or worse, 40—and realize you really have no plan in place to make sure you can buy a house, help your kids through college, take a year to travel the world, or retire before you’re 80.

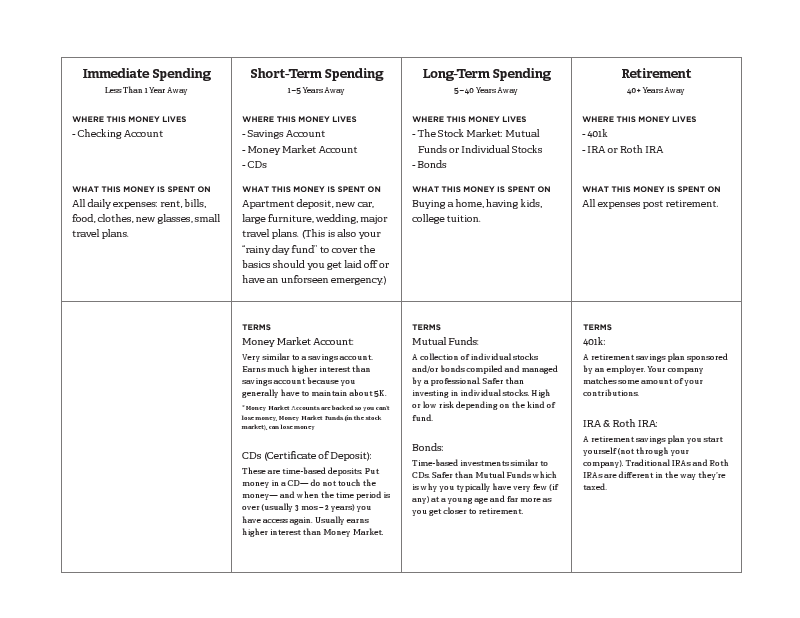

This is the first of five articles about the basics of dealing with your finances in your twenties. To start, you should be thinking about your money in categories—four categories to be exact. Four categories that are used to buy different things at different times in your life. And because they’re used at different times, for different reasons, they all live in different places. Right now we are going to go over these categories so you can keep the big picture in mind. Each of the next four articles will go in depth with one of the categories so you feel comfortable going out and making informed decisions with your money.

So let’s get into it. Oh! But before we do, if you want to make this as painless as possible, you might want to save (or maybe even print) the following chart.

All right, here we go. The first category you should think about your money in is Immediate Spending. This is the one you probably already have down pat. This is what’s in your checking account, the money that you will need within a year. This is what you use to pay your rent, bills and buy food from as well as those concert tickets you want and the new glasses you’ll need after you break your glasses at the concert. My post will focus on budgeting and my favorite way to keep track of my money painlessly.

The second category is Short-Term Spending. This is money for 1-5 years away. If you have a savings account, you already have a start on this one. But… you might not really use it for savings. It’s just… you know, that other account. While a savings account works here, I’m going to suggest thinking about a Money Market Account (which is practically the same) and/or CDs (certificate of deposit). Both simply give you higher APY (annual percentage yield, or interest rate), meaning you make more money by simply putting your money in the right place. This money is spent if you need to put a deposit down on an apartment or a new car, want to travel for a few months or in case you get unexpectedly laid off from work.

The third category is Long-Term Spending. This is the money you use to buy a house and start a family, start your own business, or to go back to school. You want to feel confident that you will not need to touch this money until 5 to 40 years from now. You want to invest this money in the stock market and/or in bonds. For all our sanity, when we talk about the stock market, we’re going to keep it to investing in mutual funds and individual stocks. Yes, the stock market can definitely seem scary, but I promise to make it as simple as I can.

The last category is Retirement. Please don’t neglect this one, guys. It’s such an easy one, and starting early has an enormous impact on how much money you retire with. This is the money for all expenses you will have post-retirement. It goes into a 401k, an IRA (individual retirement account), a Roth IRA—or some combination of these.

Okay, those are the basics. Four categories of money for four different types of spending. We will go in-depth with each category in each of the next four articles. Hopefully, by the end of this series, you’ll have a better understanding of how to start plotting your financial road map. I promise, no matter how little you have to save it isn’t as hard as it seems. Once you plot your road map, you’ll be well on your way.

Photo by Meaghan Morrison