Traffic accidents are zero fun. Whether yourself or another driver caused them, it inevitably leaves you feeling shaken and vulnerable. But fear not, because it is not the end of the world! Here are a few tips if your car is hit by another vehicle.

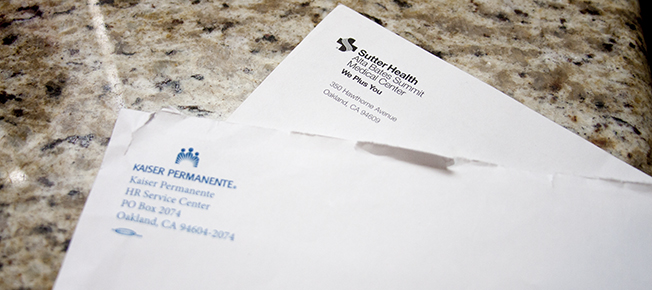

Photo by Sara Slattery

Traffic accidents can range from fender benders (which are minor and can sometimes be worked out between the drivers without insurance or police) to full-on impacts that leave cars totaled. Though, hopefully, this piece will help you with your situation, it is important to remember that every accident is different and some situations might differ significantly from what is stated here.

Keep Calm and Pull Over

First things first—when a car hits you, do not panic. This may seem like a hard thing to do, especially if airbags have been deployed, but it is important to remember that staying calm helps other passengers or drivers remain calm as well. Check and see if your passengers are okay. Then, if you can, pull over to the side of the road and put your hazards on. In some cases, it may not be wise to move your car, in case of further damage. Depending on where on the road you were hit, you can determine if it’s safe to pull over or not. (Never leave the scene of an accident without first consulting the other driver or people involved in the accident. If you do, and someone or something is damaged, you could face charges for a hit-and-run, which is much, much worse than any traffic accident).

If this is your first time in an accident, it may feel like the end of the world! But believe this from someone who has been on the road for a while: as long as your car isn’t totaled, it will be fine (and might look even better than before!) after the insurance pays for it to be fixed up.

Check Out Your Car

The next step is to assess the damage to you and your car. If you don’t have any injuries, you can check your car next. Are there scratches that weren’t there before? What about a dent on the door? Are the mirrors still fully functioning? By running your eyes up and down your car and feeling the area of impact, you will be able to tell what kind of damage you are dealing with and how it affects your car overall. Many times, cars can fully function if it’s not a significant impact, but unless you are an automotive expert, it is better to be safe than sorry.

If you have a camera phone, it’s common to whip it out at this point and document the damage to both cars.

Get Their Digits

Next, exchange information with the other driver: name, phone number, email, address, license plate number, make and model of the car, and their insurance (if they have it). You will need all this information when you contact your insurance company to file a claim. You need to give your information to the other driver, so if you don’t know it off the top of your head it is wise to keep all this info in the passenger glove compartment. If you don’t carry a pen and a pad of paper in your glove compartment, use a camera to photograph their information, or type it into your phone. (And then throw a pen and a writing pad in your car for next time!)

You should also be aware of your state’s requirements: in California, even the victim of a fender bender can get a ticket if they are found without their insurance and registration in their car. To find out if it is required for you, just look on your state’s DMV website: they will give you an outline of requirements for owning your car.

Call the Police

After getting all the information, it’s time to call the police. It might feel weird actually dialing 9-1-1, but the police will be able to act as a mediator between you and the other driver. A police report will be filed with your information, too, which is always helpful when filing insurance claims. Officers are usually very nice when it comes to traffic accidents and will only ask one or two questions depending on the damage done. If your story is different from the other driver’s, don’t panic and stick to your story.

It is important to note here that it is wise to never admit fault to the other driver or the police until you talk to your insurance company or, if necessary, legal counsel. This might sound untruthful or wrong, but sometimes traffic accidents can be chaotic and it might not be evident whose fault the accident was. Just keep your cool, tell your story, and you’ll be fine.

Examine Your Witnesses

If you talk to any witnesses, get their information as well. If it is a significant accident, police will often do this job for you, but you might need the witnesses’ help if you have to proceed legally. Ask them what they saw and if they have witnessed other accidents in the same area before. Usually you won’t need witnesses unless there is significant damage done to you or your car, so it’s up to you whether you want their help or not.

File a Claim

Finally, it’s time to contact your insurance company. Call them and tell them exactly what happened, or go online and file a claim from their website. If you lie, you could be denied coverage in the future. This phone call is very easy, though tedious, but insurance workers are usually very helpful and specific about what they need from you. As long as you have all the necessary information for your car and from the other driver, it will be as simple and quick as possible.

If your accident is minor, then your insurance company should have the matter worked out within a couple of weeks. However, the more significant the damage to you or your car, the longer the matter can take to settle, so keep track of what’s happening! Keep any pictures of any injuries and damage to your car safe and organized. Get estimates of property damage, and cooperate with your insurance company. And be patient! Sometimes it takes a while for claims to be reported or settled. Your insurance company will be in contact with you when they need you.

Being hit by a car can be exhausting, tedious, and heartbreaking, depending on the damage. But as long as you and everyone else at the incident is okay, you will be able to get through it. And never buy a car unless you can also afford insurance: it could be what saves your life!