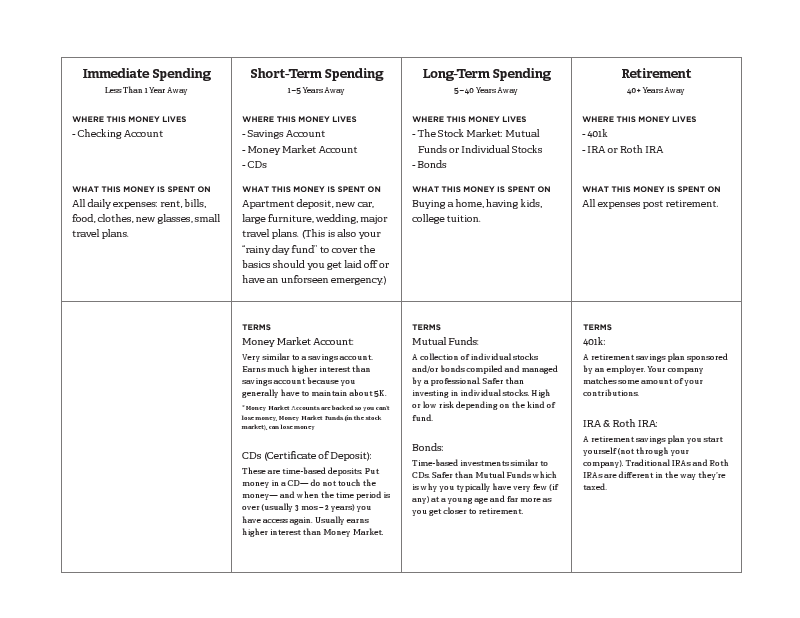

When you will use this money: within 1-5 years

Where this money lives: high yield savings account, money market account, CDs

In my last article I went over how much of your budget goes into your short-term/emergency savings account. But we still need to figure out how much money you should keep in this account. Basically, you want to have at least 3-6 months worth of expenses in your short term/emergency account. Remember, your short-term/emergency account is used in case you lose your job, need to put a deposit down on an apartment, or are planning to travel for a few months.

To figure this out: Add up your necessary expenses (rent, bills, grocery, car payment, gas, medical) plus some extra. Multiple that by six months. This is what you’re aiming for. Three months is good. Six is much better (what if your computer dies while you’re unemployed?!).

Before I go into how and where to put this money, let’s talk about how you can make money on these savings.

I have been banking with Wells Fargo my whole life. It actually says, “customer since 1988″ on my debit card. So I trust them. After I became a full-time salaried employee at my job, I went to Wells Fargo to see if my savings account (where I keep my short-term/emergency funds) could be changed to one with a higher APY (annual percentage yield = a tool for evaluating how much you earn on your savings each year) since I could start putting more money in it. I was able to switch from .01% APY to .05% APY. Five times more! I knew there were better offers at different banks but I figured they didn’t vary that much so I stuck by my bank.

Wrong.

When I started researching for these articles I looked more closely and found that you can find dozens of banks that offer up to .95% APY. They’re just not the big banks you most commonly think of—they’re mostly online banks. Online banks are able to offer much better APYs because they don’t have physical branches that are costly to run. Basically, if you have $10,000 in one of these online savings accounts making .95% APY, you make $95 a year in interest. Wells Fargo on the other hand, was giving me just $5 a year. No f*@%ing way.

It took half an hour online to open a high-yield money market savings account with Ally Bank and I found that there were some other perks too. There are no fees to have the account. With Wells Fargo you have to have a minimum balance of $3,500 or have an automatic monthly transfer go into the account. You get a debit card that you can use at any ATM and if there’s a fee, they reimburse it. This perk is nice although you shouldn’t be taking money out of this account on a regular basis.

So, let’s say you now have a sweet savings account set up and you’ve started putting money in it. Now what do you do? You don’t touch the money. What was that? DON’T TOUCH THE MONEY. This is not a second checking account. This is a comfy cushion you have hand-sewn so that if something bad happens you can fall down and be okay. If you keep taking the stuffing out of your comfy cushion, you’re gonna fall flat on your face and your face is going to look like crap.

Because this could be tricky, I’ve put together some helpful guidelines:

Ok, here are the situations when you can touch your savings: You lose your job. You have a sudden medical emergency. Your computer makes a horrible sound, goes black and never comes back. You have to put a deposit down on an apartment. You’ve been sleeping on an air mattress for the past year and need to buy a big kid bed. You need to buy a new car because Old Classy died.

Here are the situations when you cannot touch your savings: You need that $200 dress because you’re seeing your ex for the first time since you broke up. You really want to hit up Vegas this year brah. You’re too lazy to budget correctly so if you need more money, you can just take it from here, right?—This is especially NOT ok.

Exceptions: You’re using this account to save for your wedding or to travel for a long period of time. That’s ok, although I would suggest creating a separate savings account (or sub-account) for this if you can, and maintaining at least 3 months worth of expenses in your emergency account.

In researching the best place to put my money, I found some high-yield savings accounts that you should also consider:

- Ally Money Market Savings Account – 0.95% APY. No min deposit, no min balance, no monthly fee, easy to access money with debit card that can be used at any ATM without a fee. This is the account I currently have.

- ING Direct Orange Savings Account – 0.80% APY. No min deposit, no min balance, no monthly fee, ability to open sub-accounts to save for emergency, wedding, new car etc and keep that money mentally separate.

- American Express High-Yield Savings Account – 0.90% APY. No min deposit, no monthly fee.

- Discover Online Savings Account – 0.80% APY. $500 min deposit, no min balance, no monthly fee.

That being said, the best thing to do is compare savings accounts for yourself with Mint.com.

Another place to consider putting your money is in CDs (certificate of deposit). A CD is a time-based investment. You put in an amount of money (usually at least a couple thousand dollars) for a fixed amount of time (generally between 3 months and 5 years) and the bank pays you interest at regular intervals. Keep in mind if you need this money before the agreed upon date, you will be charged a fine. So if you are interested in CDs, be sure you will not need that money within the agreed upon time period. These accounts have higher APYs (historically around 2%–5%) than high-yield savings accounts so you will make more and your money will be insured by your bank (so long as you work with an FDIC-insured bank).

Pro Tip: CD interest rates are extremely low right now so it may be just as smart to keep your money in a high yield savings account at the moment.

Whether you’re ready to start saving right now or not, be sure you know the savings options that are out there for you in the future. As we learned, sticking with the same account you’ve had since you were 15 might not be the most lucrative place to put your money. Once you’re ready, you’ll feel much more confident because understanding your savings options won’t be unexplored territory.

Photo by Meaghan Morrison