Well friends, it’s time for the stock market. If you’ve read the other articles in my Finances in Your 20s series, hopefully you’ll have learned how to budget and how to save money for a rainy day. Those concepts were probably at least somewhat familiar to you—but the stock market may be something completely new and completely terrifying. It would be impossible for me to delve into everything you would want to know about investing in the stock market in this article, so I want to give you an overall framework for how to start the process and point you on your way. There are endless resources out there, so if there’s something you want to know that I don’t cover—you know the power of Google. Let’s get started.

What is the stock market?

The stock market is a general term for one of the various markets (like the New York Stock Exchange or the NASDAQ—don’t worry about the specific markets, it’s not crucial) where you can invest your money in companies. The stock market allows companies to sell shares of stock to the public. When you purchase a share of stock you have a (very small) slice of ownership of that company, and have rights to the potential gains or losses based on that company’s future performance.

Not everyone in the stock market is a rich, corporate day trader who follows the stock market on a daily basis. If you don’t have the time or money for that, don’t worry: neither do I. But if you are saving money that you don’t think you’ll need in the next 5–7 years, you should definitely consider putting it in the stock market.

How do I know if I’m ready to put money in the stock market? Do I need to open a new account?

- If you are contributing to a retirement account (401K, IRA), then you’re already ready to start.

You should be able to put the money you’re contributing into stocks, bonds, mutual funds etc. through the account you already have open online. Most retirement plans allow you to invest in individual stocks and many different stock-based funds. If you haven’t already logged into your retirement accounts online, take the steps to do so. Until you actively put that money somewhere, it will be sitting around making even less money than your savings account.

- Once you have financial stability—when you have about 6 months of expenses in your rainy day fund and are contributing to your retirement account—then you should consider opening a separate brokerage account.

If this is the case, then good job you! So, a brokerage account is just an account with a brokerage firm (Vanguard, Schwab, Scottrade, Fidelity, eTrade etc.) that allows you to invest in stocks, bonds, mutual funds, ETFs, CDs or even commodities (like gold or oil). I can’t go over everything involved, so here is some help to opening your first online brokerage account. Look at any fees brokerage firms may have, how much they charge per trade, and any minimums to open an account or to be invested in funds.

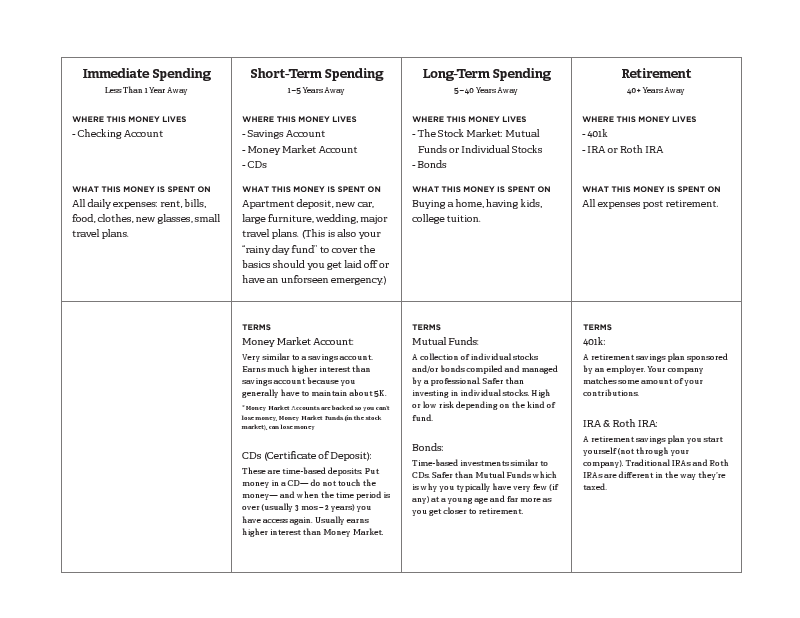

Since this account is on top of your retirement account, you may be wondering what this money is for. Well, that depends on you and your goals. Want to buy a house? A new car? Plan to go to grad school eventually? Want to take a year off and travel the world? Figure out your goals and use that as a time-frame for how risky you should be with this money, based on how soon you are going to need it. (What we’re working on is asset allocation. Become familiar with the concept.)

What should I invest in?

Because individual stocks can fluctuate so much, I suggest putting your money in funds like Mutual Funds, Index Funds and/or ETFs (Exchange Traded Funds). While all these funds are different, they are alike in that they group many companies (and other securities) together which allows you to have a diversified portfolio even with a relatively small amount of money. What this means for you is that you’re not subject to the random ups and downs that an individual company can have because your money is spread widely across hundreds of companies even though you’re only invested in a single fund.

Until you are comfortable with the stock market, it’s probably best to put your money in a couple of broad funds (like a total stock market index fund) and let the market take its course. In other words, don’t try to time the market—put your money in and leave it. If the money you’re investing is for the long-term, the ups and downs of the market will even out in the long run.

Note: Don’t feel that you need to be overly involved in managing your funds. The more passive approach of investing in index funds is actually often more successful than investing in heavily managed funds that often don’t perform as well and charge more to manage.

What should I learn about next?

There is a lot to know about investing and this just gives you an overview of the strategy that I think makes sense for beginners. And because this is just a start, I’m giving you a list of things to learn about next so that you’ll feel familiar with these terms when you come across them: Expense Ratios, Making Money with Dividends, Asset Allocation, Diversification, Rebalancing, and Stock Sectors.

I know, those may sound scary too. But I promise, the sooner you gain a basic understanding of these concepts, the easier this whole “stock market” thing will be.

Photo by Meaghan Morrison